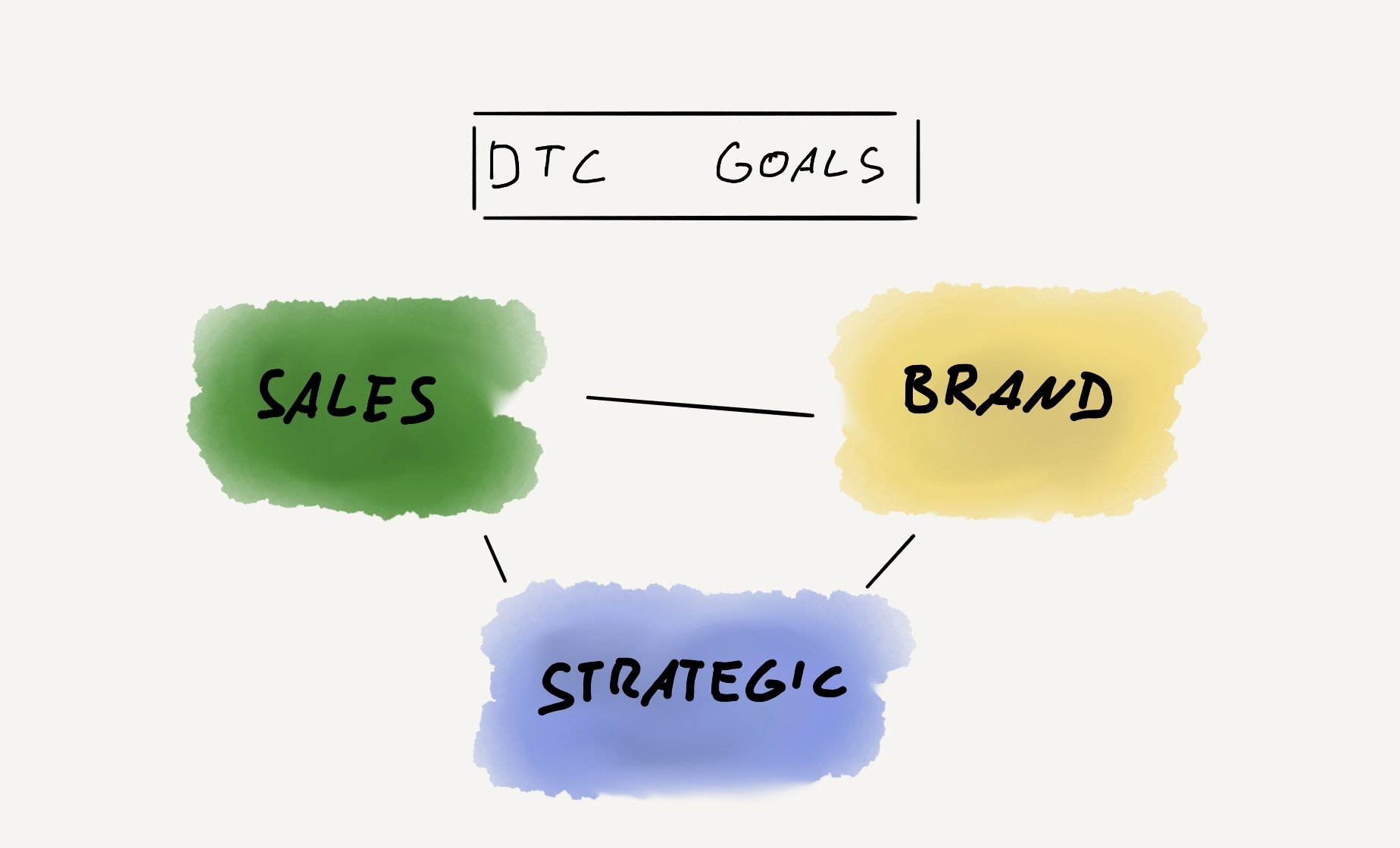

Getting into DTC can have many goals, don’t muddle them. A framework for prioritising.

There are relatively few examples of wholesale or retail brands successfully diversifying into a DTC e-commerce offering. Why is that? Brands often don’t have a laser sharp focus on the highest priority goal for their DTC strategy. It’s usually not as obvious as just wanting to generate more sales, so this takes some internal analysis.

Given that e-commerce has been generating most of the growth in consumer products in recent years, it’s understandable that every business feels the need to get on that high-speed train. And there are a lot of good reasons to, especially for many established wholesale or retail brands, because they often have an advantage over startups in their existing brand and customer base. But instead of reacting to the fear-of-missing-out, brands need to identify if DTC for them is mostly about sales, strategic opportunities or brand control.

The obvious, but short-sighted goal is to simply set out to drive direct e-commerce sales at a higher margin than wholesale. It’s assumed all the other benefits of DTC accrue automatically as a result, whether that’s higher customer lifetime value or greater insights. To some extent that is the case, in that these factors are going to help drive sales. But if brands only focus on sales goals they are missing out on the full potential of embedding DTC into their existing company strategy. Only then can they ensure the biggest internal buy-in for the DTC business. They’ll make best use of the deep customer insights generated by the DTC branch, and make each business line (wholesale, retail and DTC) support one another.

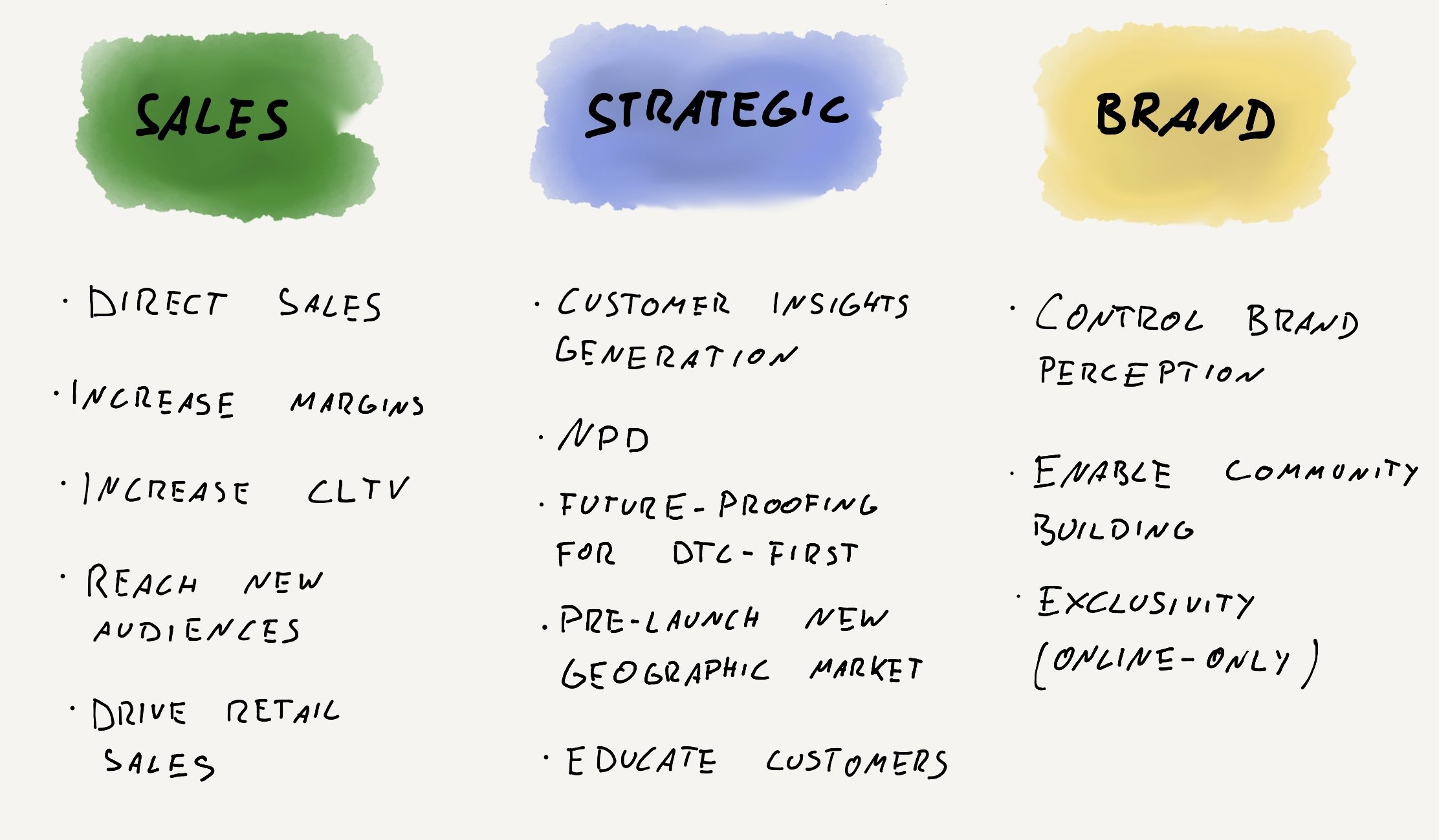

There are 13 primary goals for diversifying into DTC which can be separated into three main categories:

Sales goals

Drive direct sales

Strict control on customer acquisition costs require diversified growth channels, and strong emphasis on driving repeat purchase.

Increase margins

It’s difficult to realise higher operating margins in DTC e-commerce than wholesale, even though gross margins tend to be much higher. This is due to higher costs for customer acquisition, logistics and tech support. This makes it crucial to integrate DTC into overall company strategy to use the brand and insights benefits of DTC throughout the business. Consider outsourcing some logistics and customer service initially and to incrementally build internal resources only with scaling volumes.

Increase CLTV

Successful DTC requires a mindset shift from driving sales to driving strong customer relationships. Which of course is much more realistic to influence through digital channels, primarily email & sms, and highly targeted content. With steeply increasing acquisition costs this needs to be a primary focus for most brands.

Strategic goals

Reach new audiences

Retail & wholesale supply chains are less flexible than going direct through online channels. Brands can explore new target audiences they’re not currently reaching, potentially followed up by new related wholesale agreements.

Drive retail sales

Many consumers are willing to only buy from a brand’s online shop, but many prefer to see the product in-store and buy there, or both. The goal here should still be to drive browsing and adds-to-cart on the online shop, but give people the option to find a nearby stockist as well.

Customer insights generation

Insights generation is the biggest driver of overall company sales that arises from the DTC offering. It needs to be made use of throughout all channels, and be a continuous process.

NPD

DTC offers a more nimble route to identify and validate new products, and then take them to market. Initial validation online will make it easier to increase the retail footprint as well.

Future-proofing for possible DTC-first world

In most categories e-commerce is still not the majority of sales but that’s going to change. Relying on wholesale and retail channels alone can be risky, so there is value in building the foundations of DTC in case it becomes vital to scale it quickly.

Pre-launch new geographic market

Similar to launching new products, entering new geographical markets can bring large overheads in terms of logistics and sales. It’s possible to generate traction and customer data beforehand by targeting it through direct campaigns.

Educate customers

Products that require skilled usage or have benefits that aren’t immediately obvious (e.g. durability, sustainability) are often marketed best directly. Educating customers through content journeys significantly drives repeat purchase and word-of-mouth referrals, and hence strengthens the brand through all channels.

Brand goals

Control brand perception

Marketing products directly to consumers offers compete control over how the brand is positioned, in terms of the key messaging, visual identity and how it fits within a customer’s lifestyle. This is crucially important for premium and luxury brands, and in particular if there’s a reason to improve brand image.

Enable community building

While it’s possible to build brand communities without a DTC channel, it becomes much more powerful if integrated into the whole marketing funnel. Subscription or membership schemes, as well as events or forums strengthen loyalty, brand and insights.

Exclusivity (online-only offering)

Brands can increase their external value by offering certain products only through their DTC channel. This also makes it easier to transition towards DTC from retail, as you can serve all channels while creating an incentive for customers to shift to the DTC route.

What are some of the most relevant KPI and benchmarks to aim for in each of these objectives?

A 5-step process to prioritise and choose KPI

Usually most of these objectives are valid for brands but sustainable growth only comes with the right strategic focus. It’s very common to focus too narrowly on sales or customer growth metrics, or too broadly on several sales, marketing and community measures. In most cases, choosing the top 3 priority areas at a time gives teams a realistic chance to make fast progress and keep the bigger picture in mind.

This could be done through an OKR setup but it’s best not to be too prescriptive about the method, and instead ensure the goals fit into the existing cycles and routines of the organisation. Some objectives should only be measured in 6-12 month cycles (brand measures, education, omnichannel effects), whereas others will show results within weeks (new product validation, new markets). We usually recommend setting annual objectives, broken down into 2-4 milestones. This is much more meaningful and tangible, tied to actual processes, as opposed to the arbitrariness of calendar quarters.

Brands should go through the following five steps:

Identify the role of DTC in the overall company strategy (map out the impacts between DTC and retail/wholesale channels, in terms of how customer journeys intersect and which insights can be used throughout the business)

Rank top 3 priority objectives for the following year

Choose 1-2 KPI per objective, and the frequency of measurement (e.g monthly, 6 months, on certain events)

Allocate resources according to the prioritisation. Review no more than quarterly.

Review progress on all KPI monthly, on several milestones per year, and annually

—

Many brands, especially those established in retail channels, struggle to realise the potential from DTC channels. Usually this isn’t because of the lack of demand or unsuitability of the category for e-commerce, but because of treating DTC as just another channel that sits in its own silo. The real benefits come from integrating it into the core company strategy, and having a very clear focus on the factors that will make DTC a success in its own right and as a part of the whole business. Some of those factors will be harder to measure than others, which is why it’s important to choose a set of metrics that bring together ‘harder’ growth stats with ‘softer’ brand and community measures.