Why there’s no more competitive advantage in digital advertising in 2022

For consumer goods brands looking to grow their DTC business, there is no more competitive advantage in running digital advertising well. That’s not to say brands don’t have a good reason, or in some cases the absolute need, to still run paid advertising campaigns. But they should be under no illusion that being technically smart about digital ads will be the simple answer to their growth challenges they’re looking for. Instead they’ll need to find a new source of competitive advantage which in most cases comes from stronger positioning and insights generation, and the stronger messaging strategy that comes from it.

Digital advertising going mainstream

There are three key reasons why digital advertising doesn’t provide this edge anymore in 2022, which it likely would have done in DTC a few years ago:

Most brands are running digital ads now, including on Facebook Ads, Google Ads and the smaller platforms. Budgets have been increasing significantly. And as a result there are so many more smart digital advertising managers who have understood the basics of the mechanics of the platforms. Of course not everyone who claims the title actually does have that understanding, so brands still need to be careful to hit best practice.

High demand for ad space and the increasingly strict privacy rules have pushed up prices massively. In some categories costs have risen to a point where it’s not sustainable to acquire customers through paid digital channels. Hence the rise of subscription businesses as they tend to have much higher customer lifetime value to justify spending large on acquisition (although those CLTV estimates are often overblown).

Perhaps most importantly, the algorithm of the best platforms (mainly Facebook and Google Ads) often works best when left more or less alone - the underlying AI is more sophisticated than the manual adjustments of targeting, bidding and messaging testing. Beyond the ad platforms, much of the sales funnel has a ‘best practice’: In e-commerce the best performing shop funnel backend is mostly standardised now (with Shopify and other platforms) so again the competitive advantage needs to be found somewhere higher up the strategic ladder.

Generating new competitive advantage

Like I said there’s still a lot of value in using those channels. In some categories (highly competitive FMCG) and types of companies (PE/VC funded, public) it’s essential to even be able to compete at all. But the competitive advantage needs to come from somewhere else, stronger positioning and insights generation, and ad campaigns need to be led by those. There will be some marginal gains from running campaigns better but they’ll be tiny once you’ve picked a genuinely experienced digital advertiser.

The most promising route for DTC brands is to improve their positioning continuously, to diversify their growth activities to 2-3 other channels, and to use rigorous insights generation to feed the algorithms.

A three step approach to optimising growth frameworks:

1) Improve positioning

In consumer goods DTC brands are usually best off to position themselves based on targeting a niche audience or a very specific consumer need. This obviously doesn’t mean they need to start their company or brand from scratch. Instead it’s crucial to analyse whether repositioning or refining the positioning might be necessary. Practically this could mean adjusting the targeting, product offering and/or campaign messaging.

It’s worth keeping in mind that if a product is genuinely valuable to customers it usually doesn’t need paid advertising. We’ve become so used to the consumer industries creating, rather than just fulfilling demand, so we mostly take it as the most normal thing. But the more a product directly addresses an audience or a need that’s underserved, the more awareness and growth it will generate through organic sources (e.g. word of mouth, press and partnerships).

There are some good examples of brands that reached large scale without any or much paid advertising, e.g. Zara (customer need for on-trend affordable clothing, targeting younger less affluent shoppers in cities; using insights process to continue refining personalisation), Tupperware (direct sales route, word of mouth, brand awareness), Spanx (influencers and word-of-mouth).

It’s hard to get there, especially in FMCG, as so many products already exist. But even if not going all the way, let’s take this as an inspiration to go right direction with better positioning and a more relevant offering.

2) Diversify growth framework

This has always been important, but it’s even more crucial now in DTC than it was during the previous phase (the Second Wave) of industry disruption which benefited from cheaper ad costs. As described above, a stronger positioning strategy should drive these organic channels but it’s crucial to give them the extra support.

The most promising routes are:

Word of mouth

CRM, community building & content

Partnerships (promotional and distribution)

Organic search

Influencers

3) Feed the algorithms better & combine with ATL

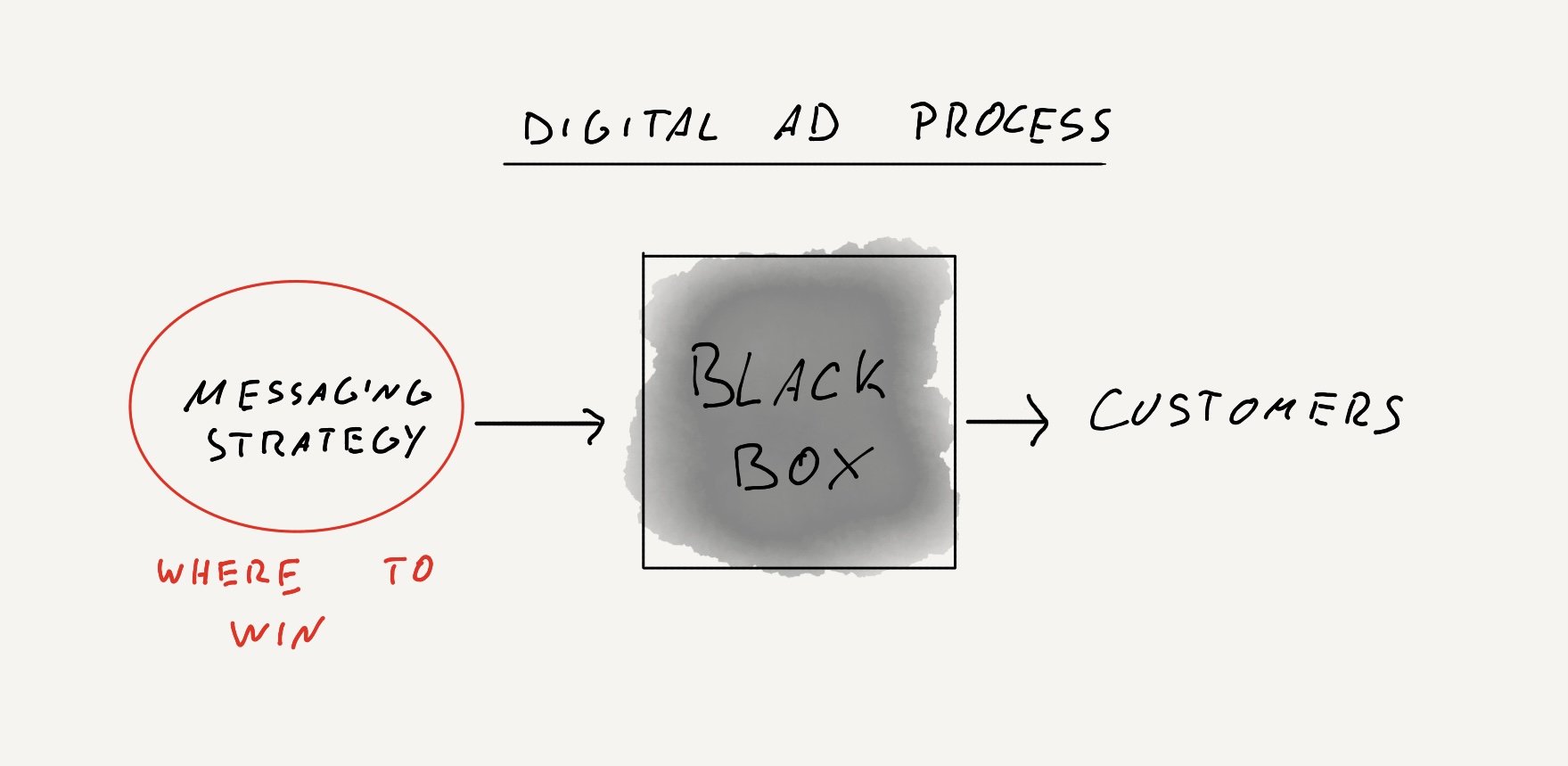

The main variables brands have to influence on digital ad platforms are the messaging and creative they use, the customer journeys to send people through, and to a smaller extent the target audiences. While the digital platforms make it easier to test those variables than more traditional channels, it’s become much less cost-effective to rely on testing, instead of doing the homework before deciding what to ‘feed’ the algorithms with.

Brands should continue to work on refining their positioning and build a stronger process to generate customer insights through the established routes (qualitative and quantitative; speaking with customers and analysing their online behaviours). This is the foundation to create a strong messaging strategy, which will then define their campaigns. A smaller amount of testing will then refine this further but a lot of gains would have already been made.

It’s often assumed this only makes sense for very large campaign budgets. But as long as a brand’s budget is large enough to venture into paid advertising (usually at least $80-150k per year), it pays off in the short and long term to be more rigorous with research.

Finally, for larger budgets, all sources of insights (from qualitative research, web and campaign analytics) should be combined to run larger awareness campaigns on above-the-line channels (video, TV, outdoor, sponsorship) which tend to be more effective at this job than more targeted digital performance channels.